Cashless India, Get Discounts On Insurance Payments, Fuel and Rail Travel

December 10, 2016

Government Decides to Print Plastic Currency Note

December 16, 2016What is Unified Payment Interface?

Unified Payment Interface (UPI) is a payment system that allows money transfer between any two bank accounts by using a smartphone. UPI allows a customer to pay directly from a bank account to different merchants, both online and offline, without the hassle of typing credit card details, IFSC code, or net banking/wallet passwords.

National Payments Corporation of India (NPCI) announced on Thursday that bank applications for the Unified Payment Interface have officially become operational, which means that UPI apps of banks can now be downloaded and used for transactions.

India moved a step closer towards becoming a cashless economy with the launch of Unified Payment Interface (UPI). With this new payment method, your smartphones will soon double up as virtual debit cards and you’ll be able to send or receive money instantly.

UPI is a great step in right direction and its is set to become an efficient alternative to mobile wallets and make cashless payments faster, easier and smoother for millions of people in India.

It has potential to make micro payments cashless which will benefit both buyers and sellers.

1) What Is UPI?

The Unified Payment Interface (UPI) can be thought of like an email ID for your money. It will be an unique identifier that your bank uses to transfer money and make payments using the IMPS (Immediate Payments Service). IMPS is faster than NEFT and lets you transfer money immediately and unlike NEFT, it works 24×7. This means that the online payments will become much easier without requiring a digital wallet or credit or debit card.

2) Who is behind UPI?

Unified Payment Interface is an initiative by National Payments Corporation of India’s (NPCI), set up with the support of the Reserve Bank of India and Indian Banks Association (IBA). The NCPI operates the Rupay payments infrastructure that – like Visa and MasterCard – allows different banks to interconnect and transfer funds.

IMPS (Immediate Payments Service) is also an initiative of NCPI. UPI is the advanced version of IMPS.

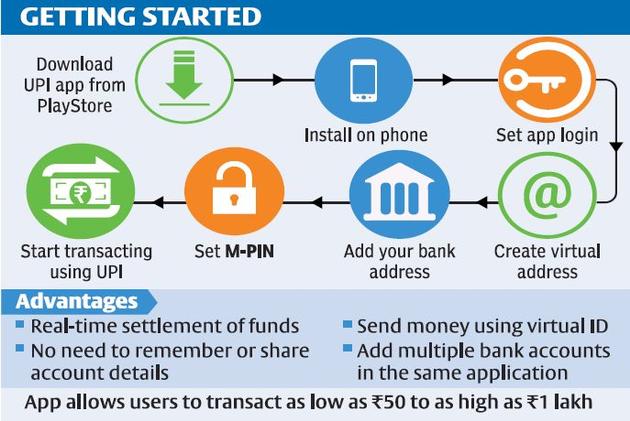

3) How Does UPI Work ?

Currently, if you want to make a bank payment online, you have to enter their account number, account type, Bank name and IFSC code. Even if you have all these details, typing it all in, particularly on a phone, is a painful process. Most banks take upto 12 hours to add a new payee and only then you can make the transfer.

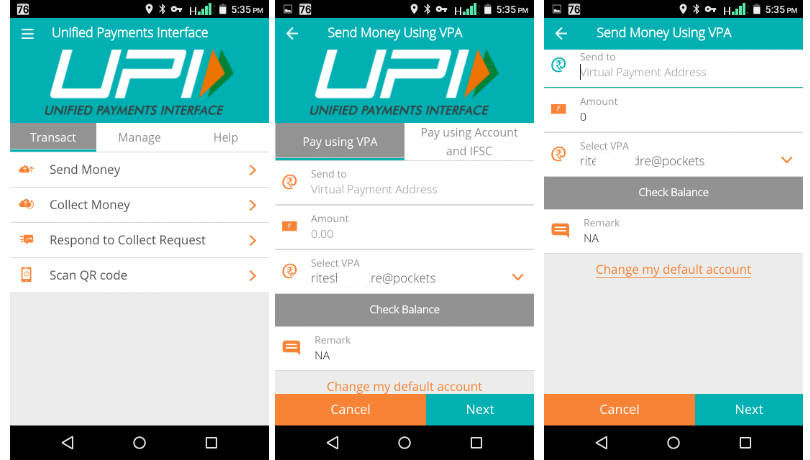

The idea behind the UPI is to do away with all of this. The interface will allow account holders across banks to send and receive money from their smartphones using just their Aadhaar unique identity number, mobile phone number or virtual payments address without entering bank account details.

According to NPCI, so far only 29 banks have agreed to start this service. If your bank is UPI-enabled, you can ask it to connect you to the system. To initiate a transaction, you can use two types of address—global or local. Global address includes your mobile, Aadhaar and bank account numbers. A local address can be a virtual address. Let’s say your bank gives you a virtual ID similar to your email ID (for instance, name@companyname). This virtual address will allow you to send and receive money from multiple banks and prepaid payment issuers.

So, you will no longer need to use a particular app to send and receive money. For example, if you use a taxi service, at the end of the journey you just have to give your virtual address and the driver will request money from it. You will get a message on your mobile phone asking for authentication. Once you authenticate the transaction by entering your password, it will be complete. This process doesn’t require either the driver or you to share bank details. Since UPI runs on IMPS, the service will be available real time and 24X7.

Nandan Nilekani, man behind Aadhar and now an advisor to NPCI, said: “UPI is a layer we have put on IMPS. It (IMPS) didn’t really have the easy debit capability and that has been addressed by this platform. We think with UPI coming, it is going to be an important merchant platform. Once it is adopted by all banks, money can be transferred from a bank to any other bank using a mobile phone”.

4) What I can do with UPI?

UPI will simplify your online payments. Now, we have to use NEFT, IMPS or a digital wallet such as MobiKwik or Paytm to make a quick payment to the service providers. With the UPI, you simply need to enter your details, and get a billing request on your phone – which you can accept or reject right away.

Taxi aggregators like Uber and Ola, food ordering services like Zomato and Food Panda, online grocery shops like Big Basket will be able to take advantage of the UPI system. Going forward, such companies should be able to register its identifier on the UPI system and receive funds from a customer’s bank account through the UPI. Most of the similar tech companies are now banking on mobile wallets.

Apart from this, you can send money to your family and friends instantly.

5) What will happen to mobile wallets?

This is a burning question asked by most of the industry watchers every since UPI was launched. Mobile wallet companies were worried and there is a reason for that.

The RBI has allowed only banks to become Payment Service Providers of UPI service, keeping mobile wallets out of the service. So, UPI has come as a boon for banks which were loosing ground to mobile wallets like PayTM, Freecharge, Mobikwik, Oxigen and Citrus Pay. Though mobile wallets have been urging the banking regulator to include them as service providers, it has not relented so far.

I think popular mobile wallets like PayTM that have good customer base can still keep using it for quick recharges and movie tickets. Cashback offers can keep them hooked to the platform little longer.

Check out some reactions from the majoj wallet companies:

“The Unified Payments Interface augurs well for us. MobiKwik already has millions of users paying their bills using the wallet,” says Bipin Preet Singh, Founder and CEO MobiKwik. “The convenience, security, and speed that we offer to users keeps bringing them back to the platform. With the Unified Payments Interface in place, our expectation is that we would unlock a new channel for growth since the universe and reach would enlarge.”

Govind Rajan, COO FreeCharge, said “We don’t want people to keep money in the wallet, we want them to use us as a processor,” he says. “That will happen because of the security and speed we can provide, so the more options there are for people the better. We’re not competing with other wallets or digital systems – right now, the challenge is to take on cash.”

Naveen Surya, Chairman, Payment Council of India & MD, ItzCash, said “We are very excited and thrilled with the possibilities of envisioning a simplified and frictionless payments infrastructure with the launch of UPI. All our non-bank members await directions from RBI and NPCI to get ready access and we can surely deliver high digital payments growth as in case of IMPS transactions.”

One thing is sure that unless these wallet companies come up with an innovative way to stay relevant, its going to be an uphill task for them to survive.

6) What about Payment Gateways?

So, we have CCAvenue, EBS, Instamojo and various other payment gateways in India. Question is, what will happen to these payment gateways once UPI is in full force.

Job of these payment gateways is to aggregate various payment methods like Credit cards, debit cards, mobile wallets and netbanking. So, the UPI might become the new net-banking, by replacing it as a payment mode.

These payment gateways also offer detailed information on received payment (who paid & for what), apart from providing transaction management, reconciliation, insights etc. They also offer customisation at every level (payment options, payment page, etc) which is beyond a simple push-n-pull movement of money via UPI.

Most importantly, Payment Gateways act like a trust custodian — one who provides protection against any dispute between merchant & consumer. This is completely missing in UPI today but it will be there as the platform matures.

7) How secure is UPI?

Nilekani said the security is fool-proof as the transaction will happen in a highly encrypted format. Already NPCI’s IMPS network handles more than Rs.8,000 crore worth of transactions a day, which will exponentially increase with the use of mobile phones.

2 Factor authentication – similar to OTP will be there as its mandated by RBI. In this case, MPIN instead of OTP will be used.

8) Is UPI available now for me to use?

It was announced in Jan 2016 and made available to banks starting 11 April 2016. However, its still in nascent stage and it will take banks little more time to figure it out and add support for it in their mobile app.

“Some banks have gone live with UPI out of 29 banks that had concurred to provide UPI service to their customers. We are confident that several banks will join UPI this year and the number will multiply further. Our focus is in line with the RBI’s vision of migrating towards a ‘less-cash’ and more digital society,” said AP Hota, MD & CEO of NPCI.

Flipkart bought PhonePe which is said to be working on a product based on UPI mechanism. Snapdeal already has FreeCharge under its wings and Amazon could make its move in the coming months. At ProfitBook, we are also planning to integrate UPI soon with our accounting software.

You might have to wait few more months before we see a working UPI app on App Stores.

9) What are the charges for using UPI?

NCPI has indicated that they will charge Rs. 0.50 per transaction. On your bank statement, it will appear as IMPS transaction.

10) Can UPI completely replace Cash or Cards?

According to RBI’s estimates, the cash floating in the system is about 18% of the country’s gross domestic product, making India as one of the most printed currency-dependent country in the world.

UPI’s success depends on few factors. For example, consider these numbers:

There are 760 million Aadhaar cards, and with 26 million of Aadhaar numbers getting added every month, soon the total Aadhaar card issuance will touch a billion by next year. Out of India’s 900 million mobile phones, 120 million are smartphones.

So, even though the use of smartphones is increasing, its nowhere near the levels of Aadhaar registration. In India, its estimated that there are over 25 million merchants and only 1.2 million have card readers. Still a major chunk of risk-averse customers hesitate to use cards.

All out efforts therefore must be made to increase smartphone penetration if UPI is to succeed, eventually rendering cards redundant for online payments.

Unified Payment Interface System[pdf]