Quick Weight Loss Naturally With Nagarmotha, Olive Oil & Green Tea

November 5, 2016

Best 12 ways to Convert Black Money to White Money Easily

November 13, 2016Why Narendra Modi Banned Rs 500 and Rs 1000 Notes from Market

A

fter the government made a surprise announcement of making Rs 1,000 and Rs 500 bank notes illegal from midnight. The Reserve Bank of India said the most important reason for the ban was the abnormal rise in fake currencies of higher denomination, and also the higher incidence of black money in the system, but assured the public that a person who changed his higher value cash will get exactly the equal amount in

lower denominations.

"It is a good initiative to reduce black money. But we need to see implementation has to be seen because the transition can be painful. However, the first thing they should do to remove all the black money is to have political parties receive donations only in cheque. Today, 75-80% of political donations happens by cash. That is the starting point for black money. I think if they had done that too. It would have brought a lot of credibility to the whole process," said Venkatraman Balakrishnan, who is also a partner of Exfinity Ventures says to Business Standard.

"You will get value for the entire volume of notes tendered at the bank branches/RBI offices," the central bank assured the public. But it was quick to add that there will be caps on the cash one can tender.

“Currency notes of Rs 1,000 and Rs 500 will be just paper with no value,” Modi said.

Image by : Google Search

Why India Banned 500rs & 1000rs Notes from Today ?

India has made a strict decision of banning regular 500 and 1000 rupee notes from circulation which is a result of finding 1.25 lakh crore black money. Indian government believes that by taking this decision we can hit black markets down and you would be least circulation of black money and fraud would not take place.

Indian Announces 2000 Rupee Note Circulation

Instead of 500 and 1000 Rupee notes RBI will be issuing 2000 rupee notes which will be a regular currency circulation over India.All those people who are worrying what to do with the stacks of 500 and 1000 notes, need not to glaze and run punching on the government. Because they have released a statement saying that all the remaining 500 and 1000 rupees notes are to be deposited at neat by Post Offices Well Indian finance is sure going to face chaos by the demoing plans of our beloved Prime Minister Narendra Modi. So, most of you might be wondering what more topics have been discussed and stated during this speech. So I have posted all of them below.

Image by : Google Search

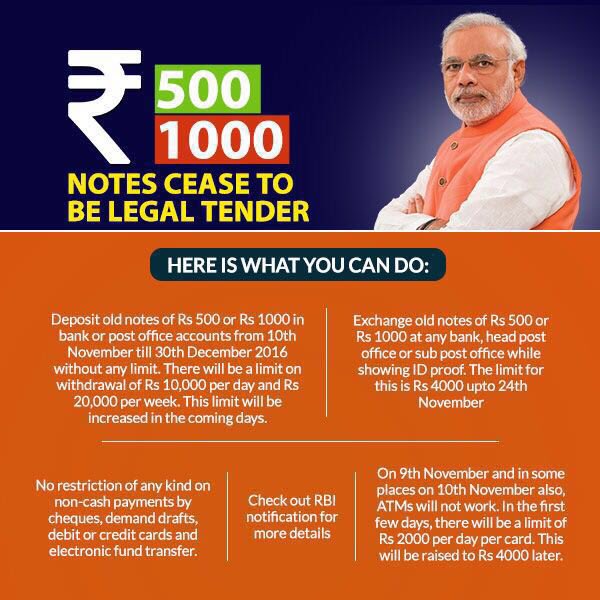

"One will get up to Rs 4,000 in cash irrespective of the size of tender and anything over and above that will be receivable by way of credit to bank account," the RBI said pointing out that one cannot get the entire amount in cash as the scheme of withdrawal of old high denomination notes does not provide for it, given its objectives.

"The fake notes are used for anti-national and illegal activities. High denomination notes have been misused by terrorists and for hoarding black money. We as a nation remain a cash-based economy, hence the circulation of fake rupees continues to be a menace. To contain the rising incidence of fake notes and black money, the scheme to withdraw high-denomination notes has been introduced," RBI said.

Banks will remain closed on Wednesday in order to withdraw the existing notes from counters and ATMs. They would, in turn, “strive to restock ATMs at the earliest and make them operational. Government has given enough exemptions to ensure that urgent needs are met. We will work round the clock to ensure that customers have a smooth experience,” Bhattacharya said.

Image by : Google Search

What is this scheme ?

The legal tender character of the notes in denominations of Rs 500 and Rs1000 stands withdrawn. In consequence thereof withdrawn old high denomination (OHD) notes cannot be used for transacting business and/or store of value for future usage. The OHD notes can be exchanged for value at any of the 19 offices of the Reserve Bank of India or at any of the bank branches or at any Head Post Office or Sub-Post Office.

How much value will I get?

You will get value for the entire volume of notes tendered at the bank branches / RBI offices.

Can I get all in cash?

No. You will get upto Rs 4000 per person in cash irrespective of the size of tender and anything over and above that will be receivable by way of credit to bank account.

Why I cannot get the entire amount in cash when I have surrendered everything in cash?

The Scheme of withdrawal of old high denomination(OHD) notes does not provide for it, given its objectives.

Can I withdraw from ATM?

It may take a while for the banks to recalibrate their ATMs. Once the ATMs are functional, you can withdraw from ATMs upto a maximum of Rs.2,000/- per card per day upto 18th November, 2016. The limit will be raised to Rs.4000/- per day per card from 19th November 2016 onwards.

Some Features of the New Bank Notes of Rs. 500

- New Rs. 500 notes are different from the present series in colour, size, theme, location of security features and design elements

- Size of new note is 63mm x 150 mm

- Colour of the note is stone grey

- The predominant new theme is Indian heritage site – Red Fort

- A Nano GPS Technology Chip is Embedded in it.

Image by : Google Search

Some Features of the New Bank Notes of Rs. 2000

- RBI:Rs. 2,000 notes will be part of Mahatma Gandhi (New) Series

- New Denomination has motif of the Mangalayan on the reverse, depicting the country’s

- first venture in interplanetary space

- Base colour of note is magenta

- Note has other designs, geometric patterns aligning with the overall colour scheme

- Size of the new note is 66 mm x 166 mm