All About GST (Goods and Services Tax) in India

November 30, 2016

Top PHP Frameworks For Developers

December 8, 2016All You Need to Know About Govt's Latest Tax Proposals on Black Money

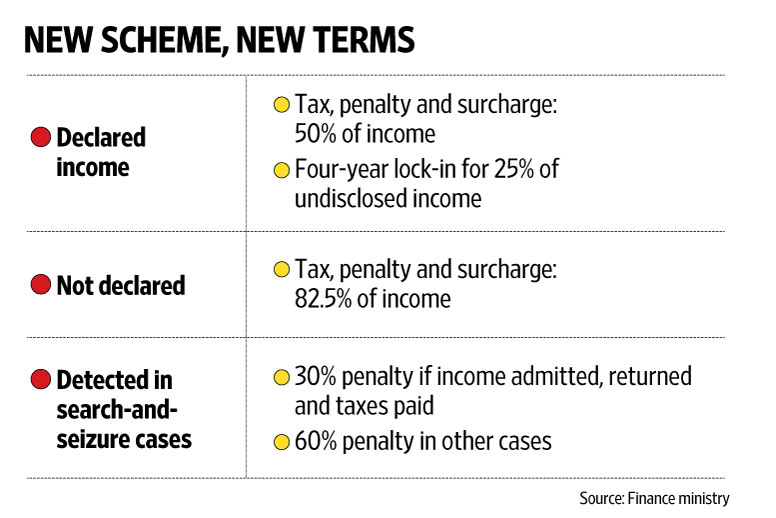

P roviding a window to black money holders, the government on Monday proposed to levy a total tax, penalty and surcharge of 50 per cent on the amount deposited post demonetisation while higher taxes and stiffer penalty of above 80 per cent await those who don't disclose but are caught.

Q. What is the new scheme?

A. The government has proposed that the people holding black money can declare their black money and pay almost 50 percent of income as tax & penalty.

Image by : Google Search

Q. Is there anything else I have to pay?

A. Apart from 50 percent tax and penalty, you will have to deposit 25 percent of declared income in interest-free Deposit Scheme for four years. This would essentially mean that you immediately get 25 percent of the declared amount in the form of white money.

Q. How has the government arrived at the figure of 50 percent?

A. The government has decided to levy 30 percent as tax on undisclosed income. On this 30 percent, one has to pay 33 percent as a surcharge and 10 percent of the declared amount will be charged as penalty. This would mean you will have to pay 49.9 percent.

Q. Why this scheme?

A. The government was getting a feedback of a lot of black money conversion through illegal routes. This proposal would give an opportunity to people to come clean and in turn, the government will also get additional revenue. Apart from this, IT Authorities had also brought to the knowledge of government that there are existing provisions in the IT Act that could be used for concealing black money

Q. What if I had submitted below 2.5 lakh rupees in my bank account?

A. Under the Income tax act, income up-to 2.5 lakh is exempt from tax. However, if you have given your account for hoarding of black money, you can land into trouble.

Image by : Google Search

With the ban on 500 and 1,000-rupee notes now more than two weeks old, the government has proposed new rules to tax black money that is being unearthed. The bill was submitted on Monday for parliament's review by Finance Minister Arun Jaitley as the government is being attacked by a united opposition over its sudden withdrawal of 86 per cent of the notes in circulation to check black money and corruption. The move has plunged the country, especially rural India, into a major cash shortage.

Government's New Income Declaration Scheme In 10 Points

►The old 500-and 1,000-rupee notes must be deposited in banks by the end of the year. Deposits over 2.5 lakhs will be studied by tax officials.

►Those who acknowledge they have placed black or previously untaxed money in their accounts will pay 50 per cent in a combination of levies and taxes.

►A disclosure scheme called the Pradhan Mantri Garib Kalyan Yojana (PMGKY) 2016 allows people to deposit money till April by paying 50 per cent of the total amount -- 30 per cent as tax, 10 per cent as penalty and 33 per cent of the taxed amount -- that is 10 per cent -- as Garib Kalyan Cess.

►So the taxes and levies will equal nearly 50 per cent of the deposit. 25 per cent of the money that remains after taxes will be available to the account holder.

►The other 25 per cent or rest of the black money that's being converted will be used by the government for four years in a special new fund that will be called the Pradhan Mantri Garib Kalyan Yojana and will be used to fund welfare schemes. No interest will be paid to the owner for this.

►If the owner refuses the option of the government bond mentioned above, 85 per cent of the amount will be taken in taxes and penalties.

►For money that is found in raids, taxes and penalties will take nearly 90 per cent of the amount, leaving 10 per cent with the owner.

►The new proposal was brought to parliament today by Finance Minister Arun Jaitley.

►It is almost certain to be cleared in this winter session of parliament because it is being considered by the Lok Sabha, where the government has a huge majority.

►As a Money Bill, it will be reviewed by the Rajya Sabha, but cannot be rejected by the Upper House, where the government is in a minority.