PocketScan World’s Smallest Wireless Scanner

November 23, 2016

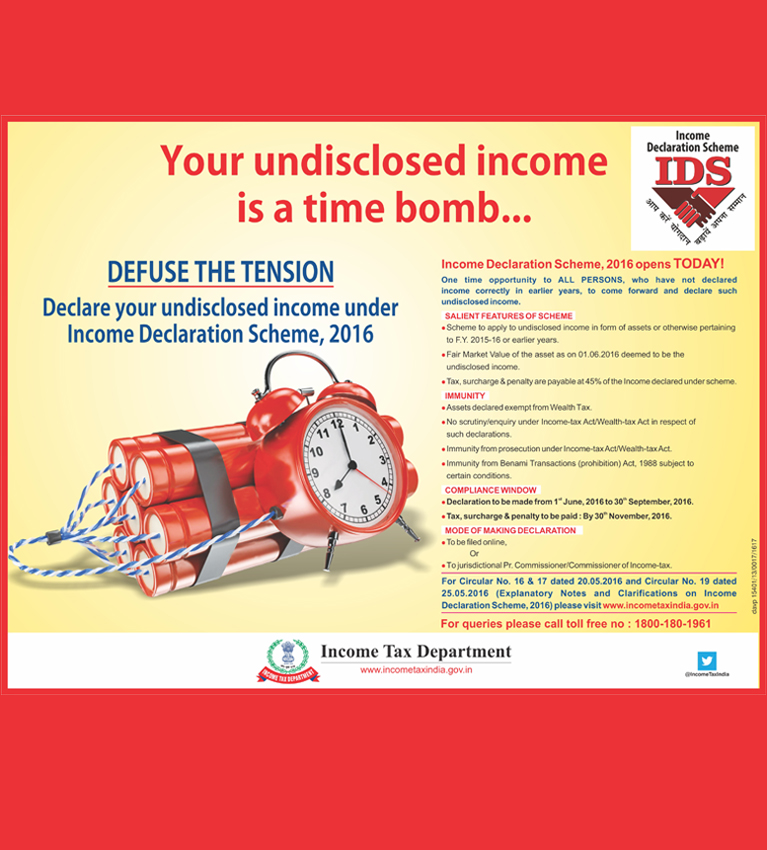

Know About Latest Tax Proposals on Black Money By India Government

November 30, 2016Goods and Services Tax (India)

"Goods and Services Tax" is a proposed system of indirect taxation in India merging most of the existing taxes into single system of taxation accordingly . Goods and Services Tax (GST) would be a comprehensive indirect tax on manufacture, sale and consumption of goods and services throughout India, to replace taxes levied by the central and state governments. Goods and Services Tax would be levied and collected at each stage of sale or purchase of goods or services based on the input tax credit method. Administrative responsibility would generally rest with a single authority to levy tax on goods and services. Exports would be zero-rated and imports would be levied the same taxes as domestic goods and services adhering to the destination principle.

What is meant by GST bill?

GST stands for "Goods and Services Tax", and is proposed to be a comprehensive indirect tax levy on manufacture, sale and consumption of goods as well as services at the national level. It will replace all indirect taxes levied on goods and services by the Indian Central and State governments.

When GST will apply in India?

The Goods and Service Tax Bill or GST Bill, officially known as "The Constitution (122nd Amendment) Bill, 2014", would be a Value added Tax (VAT) to be implemented in India, from April 2017.

What is the GST rate in India?

In India Dual model of GST will be applicable wherein both centre and state would be able to levy GST just like Brazil and Canada. 13th finance commission recommended a rate of 12%. State says they will not settle for anything below 15% .However governement would settle between 14%-16% .

What is Goods and Services Tax?

The Goods and Service Tax (GST) is a Value (VAT) to be implemented in India, from April 2016. It will replace all indirect taxes levied on goods and services by the Indian Central and State governments. It is aimed at being comprehensive for most goods and services..

The introduction of Goods and Services Tax (GST) would be a significant step in the reform of indirect taxation in India. Amalgamating several Central and State taxes into a single tax would mitigate cascading or double taxation, facilitating a common national market. The simplicity of the tax should lead to easier administration and enforcement. From the consumer point of view, the biggest advantage would be in terms of a reduction in the overall tax burden on goods, which is currently estimated at 25%-30%, free movement of goods from one state to another without stopping at state borders for hours for payment of state tax or entry tax and reduction in paperwork to a large extent.

EY Tax Alert

Government releases draft rules for registration, invoice, payment, return and refund under GST. This Tax Alert summarizes

various drafts rules released by the Central Government in relation to Goods and Services Tax (GST). The Rules pertain to :

►Registration

►Invoice

►Payment

►Returns

►Refund

Various formats for the above have also been released in public domain. Draft rules deals with the procedure in relation to payment, registration, invoicing, returns and refund under proposed GST law. Comments/representations on the draft rules have been invited by 28 September 2016 which will be discussed and finalised during the meeting of GST Council scheduled on 30 September 2016.

HUL said in a investor's presentation. But the company strongly believes that demonetisation and GST are significant growth driver for India and a win-win for everyone, it added. According to the company, demonetisation and GST would help industry with "simpler and effective compliance" and "level playing field". It would benefit the country with "higher investment led growth" and the government with "lower fiscal deficit and higher tax base". Consumers will benefit by lower inflation, HUL added.

In short term, consumers would be impacted by lower cash on hand and would be cautious with their spend. Initially, they would spend only on basic necessities. HUL further added that trade would be down due to liquidity squeeze and there would stocking of the material as a short term measure. Its impact would be varied across the geographies but the wholesale trade would be impacted the most. Moreover, in the long distance routes, there would be logistical impacts also.

According to the company, gradual improvement in the market impact is expected to be led by urban segment and would depend on liquidity build up across the chain. "Speed of recovery will be dependent on liquidity build up across the chain," said HUL in presentation copy submitted to BSE. On November 9, government withdrew Rs 500 and Rs 1,000 notes as part of a crackdown against black money and people have been facing cash crunch. The government is also aiming to kick off GST from April next year. The Goods and Services Tax (GST) will subsume excise, service tax, VAT and other local levies.