Paytm Allegedly Cheated of Rs. 6.15 Lakhs by Customers – FIR By CBI

December 17, 2016

How to Become a Professional Writer

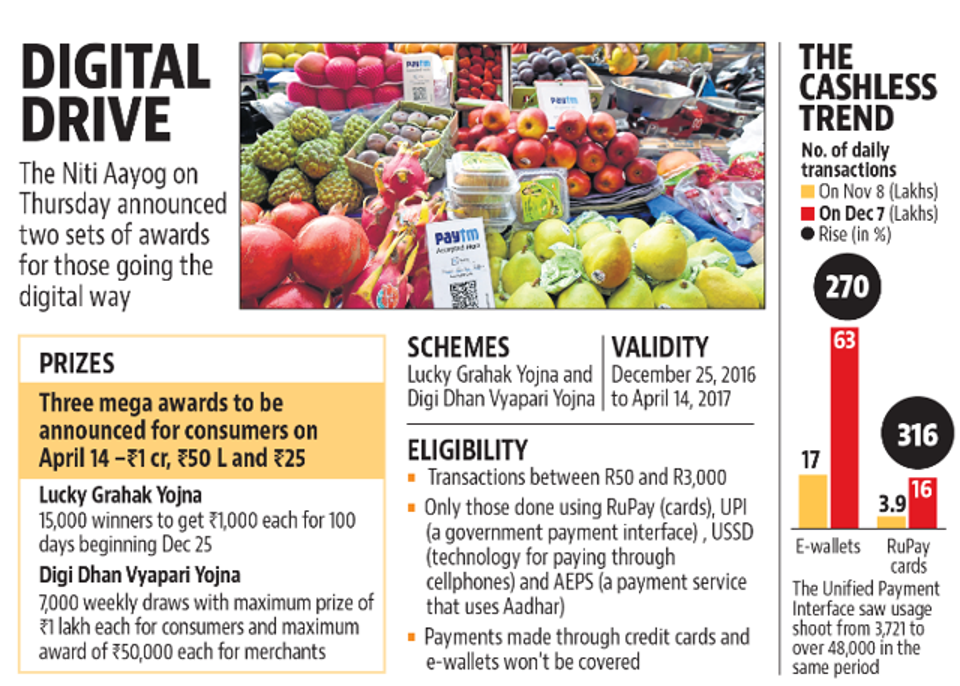

December 31, 2016Niti Aayog Lucky Grahak Yojana & Digi Dhan Vyapari Schemes

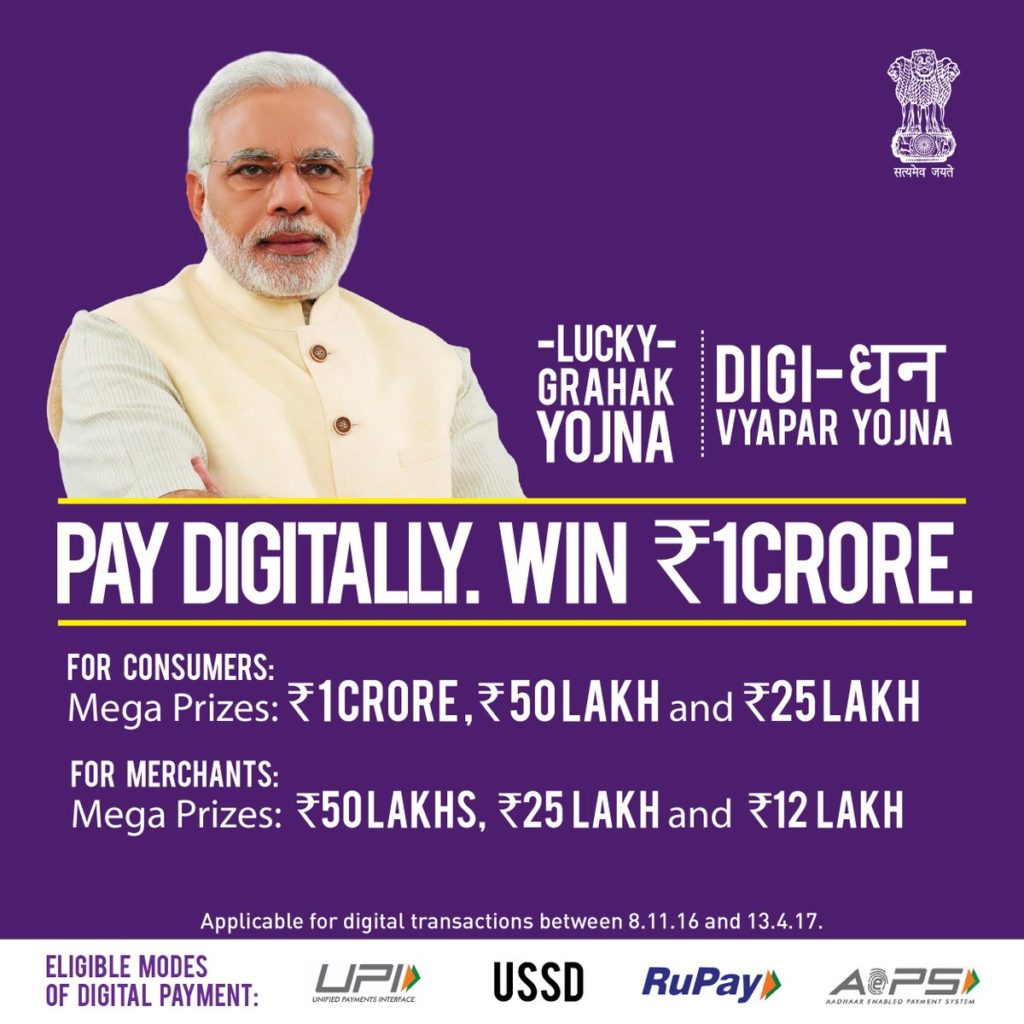

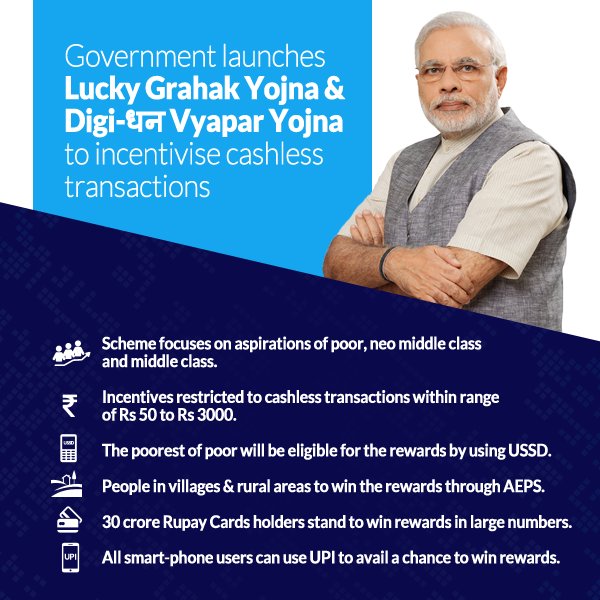

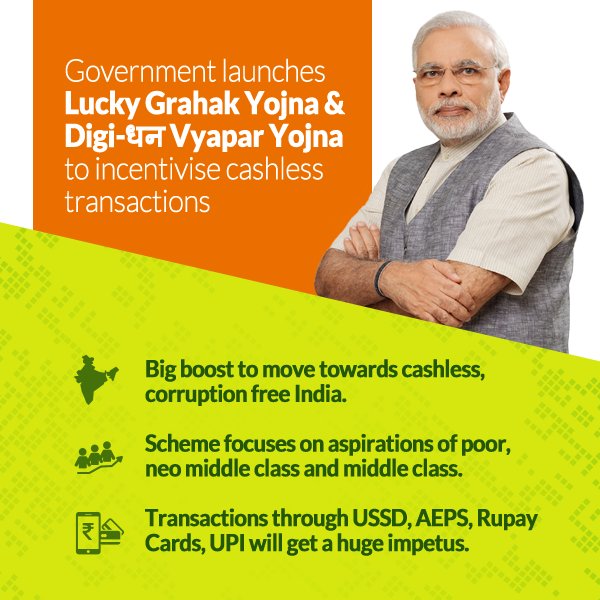

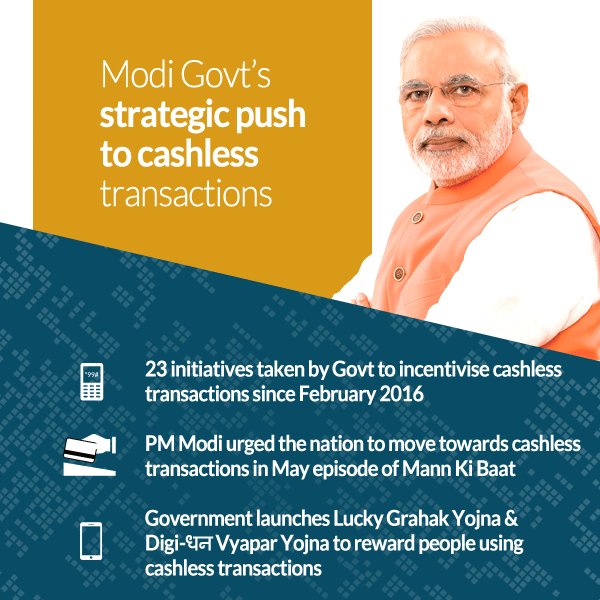

To promote the cashless digital payment government is giving you the rewards. Government Launches 2 Schemes for Encouraging Digital Payments in Online. The prize money goes upto Rs 1 Crore. Daily 15,000 people would get prize. The prize winner would be decided on the basis of lucky draw. As far as I know this is the first time that government is going for lucky draw to promote its initiative. The lucky Grahak Yojana is a big scheme and give you the cash prize. Thousands of people is going to get rewards through this scheme. Government is spending Rs 340 Cr for this digital payment lucky draw. Those People will Get Up to 1 Crore Cash Prizes on April 14, 2017.

Form of Payments Using : Rupay, UPI Apps, AEPS, USSD

Timeline of Transaction

The lucky Grahak Yojana is applicable from the back date. The digital payments done from 8th November 2016 to 13 April 2017 would be eligible for Lucky draw. The lucky draw starts from 25 December. Since it goes upto 13 April, there would be more than 100 days. It means there would be some holidays.

Amount Limit for Lucky Draw

This scheme is designed to promote digital payments among the lower middle and poor class. Hence, there is upper limit for the transactions. The digital and card payments of more than Rs 3000 would not be eligible for lucky draw. There is a minimum limit of Rs 50. Every transaction between this limit would be eligible for lucky draw. The more you use the digital payments, more would be chance to get a prize. To be eligible for this scheme, you should limit your transaction to Rs 3000. If your bill is exceeding, you should split it.

Other Conditions For Lucky Grahak Yojana

The digital payment should be only for the items of personal consumption. Any digital payment for business purposes is not eligible for this scheme. All transactions between consumers and merchants; consumers and government agencies and all AEPS transactions will be considered for the incentive scheme. Person to person fund transfer is not eligible for the lucky draw. However, it is unclear that how would government differentiate between a merchant and common person.

How The Scheme Works

The Government has not given the functional details of this scheme yet. However I am telling you all the available information.

- The Scheme would be conducted by the NPCI as UPI, USSD, AEPS and Rupay transaction goes through the NPCI.

- The NPCI would use the transaction ID for the lucky draw.

- You don’t need to do anything for this lucky draw. The NPCI would itself use your transaction ID for the draw.

- The winners shall be identified through a random draw of the eligible Transaction IDs. The IDs are generated automatically as soon as the transaction is completed.

- The NPCI uses especially developed software for this lucky draw

- NPCI ensures a technical and security audit of the draw to ensure that the technical integrity of the process is maintained.

- The Niti Aayog would fund this lucky draw scheme. The total cost would be about Rs 340 Crore.

Who Can Take Part

Every bank account holder can take part in this Lucky Grahak Yojana. Only you have to do a digital payment through any of the given mode.

- If you have internet and smartphone, you should use UPI. As it is an easiest method of payment.

- Shop or pay to merchant using your Rupay debit card. There are 30 Crore Rupay Debit cards in India.

- The feature phone users can dial *99# for USSD banking. It is useful to those who don’t have access to smartphone and internet.

- People living in distant areas can use AEPS. It works on Micro ATM or Micro POS.

Eligibility For Lucky Grahak Yojana

These prizes would be given to those consumer who pay using the cashless mode/digital payment. The payment should done from any of of the following mode.

- Unified Payment Interface (UPI) – This is mobile app based payment system. Most of the banks has integrated the UPI to their existing mobile apps. SBI Pay, PNB UPI, Axis Pay, PhonePay are the standalone UPI apps.

- USSD *99# Banking – This system of payment is for those who don’t have a smartphone or internet. To use this type of payment you have to dial *99# from your feature phone.

- Adhaar Enabled Payment System (AEPS) – This payment system does not require phone, internet or signature. This is done on the micro ATM using your Adhaar and fingerprint.

- Rupay Card – This may be debit or credit card like Visa and Mastercard. The NPCI has developed this payment gateway. All JanDhan Account holders have got this type of debit card

Reward for Digital Payment

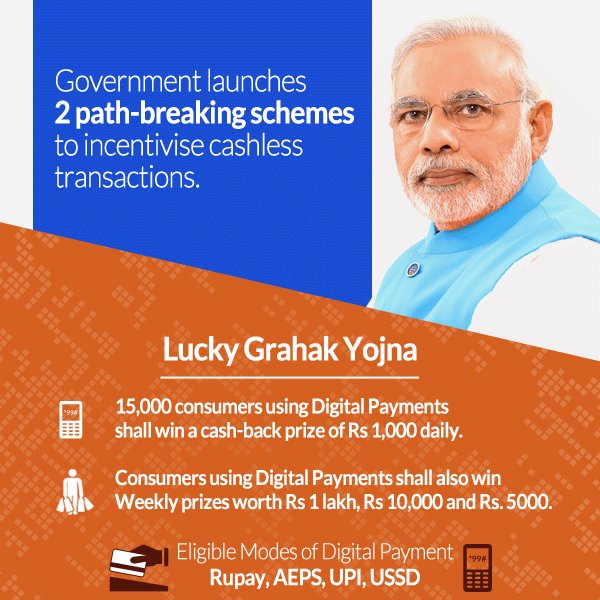

There are various types of prize under this lucky Grahak Yojana. There would be daily prizes, weekly prizes and Mega prize.

Daily Prize To Lucky Consumer

- Daily 15,000 people would get the prize

- Every person would get Rs 1000.

- The Prize would be given for 100 days

Weekly Prize

- Weekly prizes worth Rs 1 lakh, Rs 10,000 and Rs. 5000 for Consumers.

Mega Prize

The Mega draw would happen on 14th April, on the day of Ambedkar Jayanti.

- 3 Mega Prizes would be given

- The first prize would be of Rs 1 Crore

- Second prize is Rs 50 lacs

- and Third prize is Rs 25 lacs

How To Participate In Lucky Grahak Yojana Through UPI

How to be Eligible for ‘Lucky Grahak Yojna’ as well as ‘Digi Dhan Vyapari Yojna’ Using UPI App.

- 1.Create Your VPA- Virtual Payment Address on any UPI Enabled Bank App.

- 2.Link with your Bank Account and Set transaction Pin.

- 3.Ask Your Shop nearby where you ‘Pay by Cash’ to create VPA of their Bank AC too.

- 4.Ask Shop Owner to generate QR Code of their VPA using link(QR Code Generator) below by entering name & VPA.

- 5.Generate and Print QR Code As well As VPA to display at Payment Desk of shop.

- 6.Now every time you buy, Pay on his VPA address OR ‘Scan & Pay’ using your UPI App (Which facilitate scan feature).

- 7.Now Consumer & Merchant transaction is Eligible for ‘Lucky Grahak Yojna’ as well as ‘Digi Dhan Vyapari Yojna’ for payments between Rs. 50 – 3000 using UPI.

Highlights

By Spending Rs 50 to Rs 3000 Digitally Can Make You Crorepati